Payroll Information

Payroll Office Information

Location

Thomas McLean Administration Building, room 101

Payroll & Benefits Supervisor

Please email: Angela Burton at burtona@faytechcc.edu

Phone Number: 910-678-8341

Room#: 101B

Employee Benefits

Please email Brenda Nightingale at nightinb@faytechcc.edu

Phone Number: 910-678-8240

Room#: 101CC

PT Payroll

Please email Judy Hollingsworth at hollingj@faytechcc.edu

Phone Number: 910-678-8356

Room#: 101D

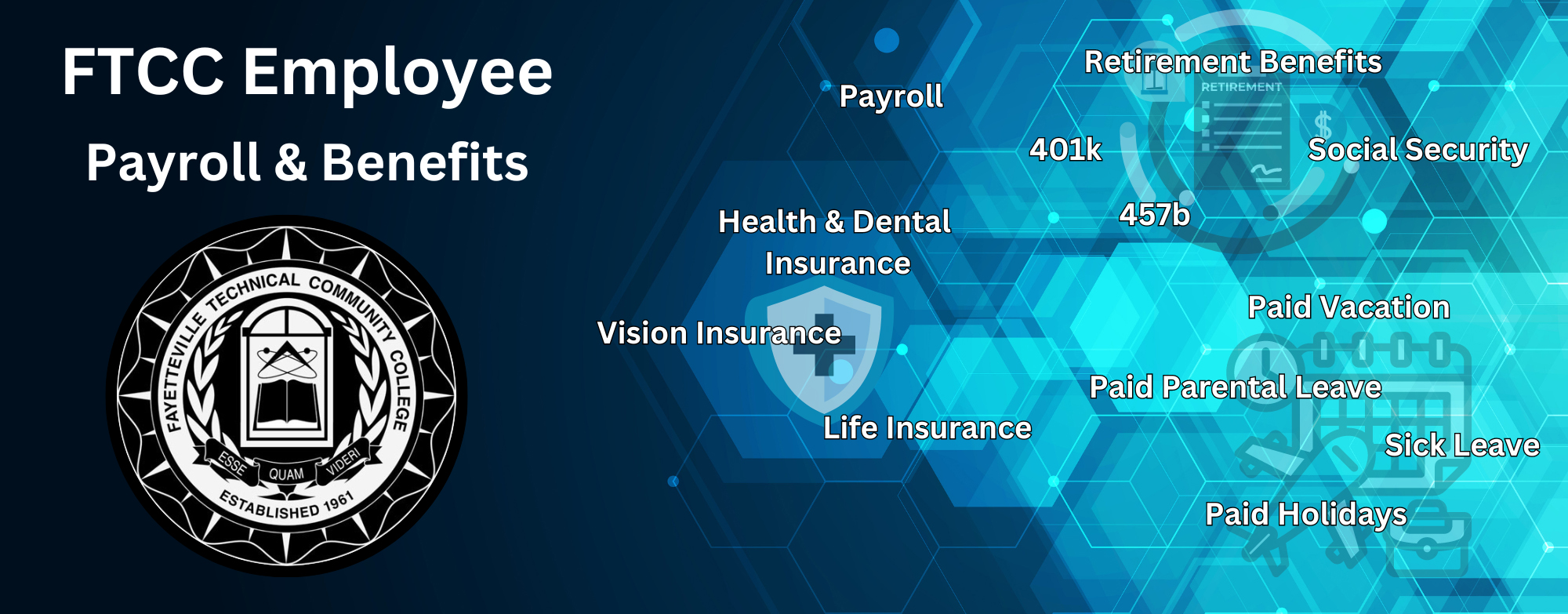

FTCC offers a comprehensive benefits program to its employees.

“Learn more by watching the ‘Open Enrollment Briefing’ video below!”

Open Enrollment Briefing

Coming Soon!

Insurance

Dental Plan

Current Premiums

The rates below are effective January 1, 2025 – December 31, 2025:

| Plan Type | Premium |

|---|---|

| Employee Only | $7.61 |

| Employee/Spouse | $45.19 |

| Employee/Child(ren) | $56.86 |

| Employee/Family | $90.22 |

Full-time, non-temporary employees at FTCC may purchase dental insurance for themselves and their families at group rates. The premiums are payroll deductible and available under the Cafeteria Plan.

The current dental plan for College employees is provided by SunLife. FTCC pays a portion of the premium for employee only coverage for full-time, non-temporary employees.

Benefits are paid as follows:

The benefits table below outlines the percentages paid for different dental services:

| Service Type | Benefit |

|---|---|

| Preventative Benefits | Paid at 100% |

| Basic Services | Paid at 80% |

| Major Services | Paid at 50% |

| Orthodontia Benefits | Paid at 50% after a 12-month waiting period (Orthodontia calendar year maximum = $500, Lifetime maximum = $1000) |

| Calendar Year Maximum Benefit Per Person | $1,250 |

Note: Percentages for all services shown are based on usual and customary charges.

Deductible

There is a $25 calendar year deductible. No family will be responsible for paying more than three deductibles per year, regardless of the number of family members insured under the plan. The deductible is waived for Preventative Services.

Retirement Benefits

FTCC full-time employees enjoy a generous benefit package, which includes an excellent retirement plan. Each full-time employee contributes 6% of their compensation on a pre-tax basis to the retirement plan and the remainder of the retirement benefit is funded by the College.

Types of Leave

Annual Leave

Non-Temporary, non-faculty of FTCC accrue annual leave based on aggregate state service. The amount of leave earned varies according to the length of service. On June 30, any employee with more than 240 hours of accumulated leave shall have the excess accumulation transferred to their sick leave account.

Faculty receives Administrative leave based on the type of contract they sign.

Vacation leave for full-time, non-temporary employees shall be computed at the following rates:

The table below outlines hours earned monthly and annually based on years of service:

| Years of Service | Hours Earned Monthly | Hours Earned Annually |

|---|---|---|

| Less than 5 years | 9 hours 15 minutes | 111 |

| 5 but less than 10 years | 11 hours 15 minutes | 135 |

| 10 but less than 15 years | 13 hours 15 minutes | 159 |

| 15 but less than 20 years | 15 hours 15 minutes | 183 |

| 20 or more years | 17 hours 15 minutes | 207 |

Additional Benefits

Cafeteria Plan (IRS Code Section 125)

The cafeteria plan allows employees to have certain insurance premiums deducted from monthly earnings before taxes and social security are computed.

Social Security

All employees of FTCC are eligible for social security benefits according to the laws and regulations governing the Social Security Administration.

Retirement, Auxiliary and Survivors Benefits

Disability Benefits SSIDI/SSI

Accessing Services

Medicare